New Paradigm: Value Creation in Risk Management

Leave a commentJune 21, 2013 by mochhasan

“We must guard the bottom line of our corporate earnings by strengthening the risk management function”, that is usually how conventional peoples see risk management function. Conventional peoples see that risk management is all about safeguarding the corporate from any potential damage and probability loss. Therefore, it not surprising for you to hear the conventional risk manager saying, “NO, that is too risky. NO… we must comply with certain procedures. NO, we must take the safest one”. Is it wrong? I can’t say that one. But is there any better option? In my opinion “Maybe, yes”.

As far as my understanding, risk management can offer better value by giving relevant support for business to grow in strong manner. So that, risk management must be in the same direction of business and be adaptive to any change of business. The different games that business plays, can lead different role that risk management must take to give optimum value for the business. In that new paradigm, risk management will no longer be seen as just static function to ensure safeguard, but it will be seen as integrated function of value creation for corporate. One example of that new paradigm, is implementation of risk based pricing in two wheel multi-finance industry due to new regulation of down payment.

The change of regulatory environment (“related to minimum requirement of down payment” based PMK No.220/PMK.010/2012) in to wheel multi-finance industry has lead to the change of business game in two wheel multi-finance industry. At least, there are two impacts in multi-finance industry because of the new regulation of minimum down payment. One, multi-finance company can expect better profitability due to lower risk-associated cost. Second, the market size of two wheel multi-finance company will shrink in respond to the increase of minimum down payment. Given the change of business game, the role of risk management is expected to change from safeguard of bottom line to the front line of price-competition. Why pricing will be important in two wheel multi-finance industry since the issuance of new regulation? Because there is no way multi-finance will compete with low down-payment anymore, they must think other bazookas to compete with others. One of them is pricing.

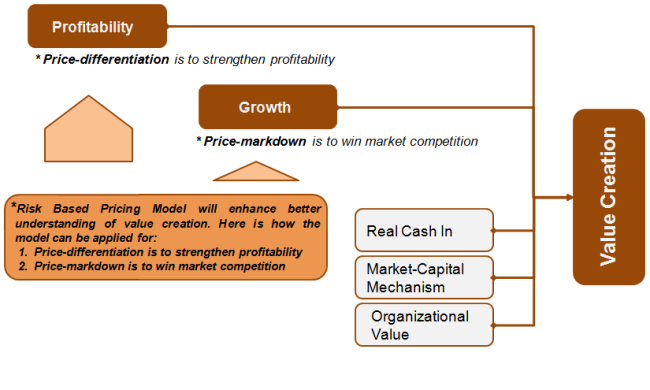

(Diagram One)

Given two impacts in current industry, there are two initiatives of value creation based on risk-based pricing theory. They are price mark-down and price differentiation (see diagram one).

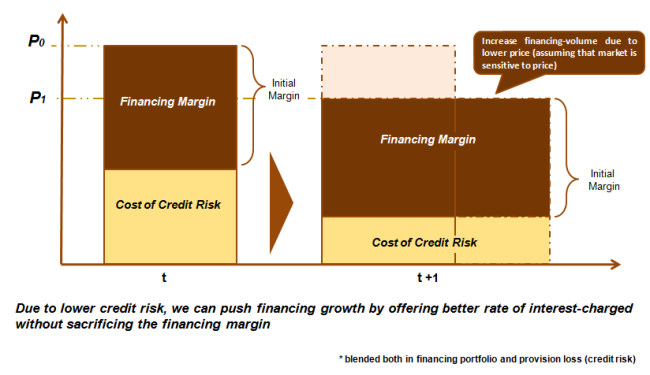

Price mark-down is intended to boost growth, given current industry shrinkage.This price mark-down will not hit the profitability level because the industry is expected to have better margin in the future. So that, by maintaining current level of profitability, the industry player can boost their growth by capture bigger market-share (see graph one).

(Graph One)

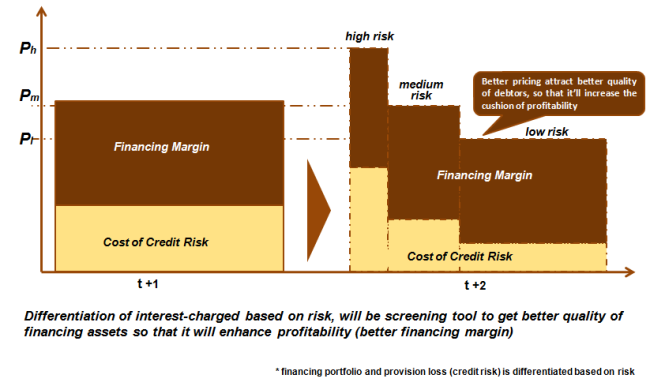

Price differentiation is intended to enhance profitability level by strengthening the quality of financing assets. For any given price level, the better quality of assets means the lower risk-associated cost that must be paid and it the-end will result better profitability. How price-differentiation will enhance profitability? When higher risky customers are relatively charged higher price, they will do prefer to reject the deal and look for other multi-finance company. On the other hand, when less riskycustomer are relatively charged better price, most of them will prefer to stay instead of going out to look for other multi-finance company (see graph two)

(Graph Two)

Our previous example confirms our understanding that risk management is not merely about safeguard function, but it can also play roles for value creation. That is what we call it as new paradigm of risk management.